Loans can be a basic help in the midst of unforeseen emergency, or a device making up versatility conceivable — inasmuch as moneylenders figure out the expenses. “Loan Calculators Work can assist you with covering practically any buy or solidify higher-interest obligation,” says Leslie Tayne, the pioneer and head lawyer at Tayne Regulation Gathering, which works in purchaser obligation. Normal purposes incorporate paying for home enhancements, doctor’s visit expenses, or startling costs.

“The borrower gets one single amount and afterward takes care of it through a Loan Calculator of fixed regularly scheduled installments for a decent reimbursement period, making it simple to spending plan for and know precisely when the loan will be paid off,” makes sense of Matt Lattman, VP of individual loans at Find Loans.

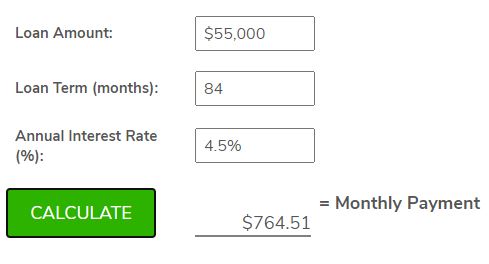

Prior to assuming an individual loan, it’s critical to know how much the regularly scheduled installments will be and whether your financial plan can sensibly oblige the additional cost. However, deciding the specific portion installments ahead of laying out Loan Calculators Work can be troublesome.

While applying for a line of credit, it’s fundamental to comprehend how much you’ll need to pay every month. This can assist you with better looking at moneylenders and conclude whether a premium just or amortized loan is the best fit. While it’s feasible to compute loan installments all alone, various loan installment calculators are accessible for the vast majority of the most widely recognized kinds of loans.

How personal loan payments work

Notwithstanding your loan’s chief sum, you’re on the snare for interest and any charges related with an individual loan. In your loan, you can separate the expenses by:

- Head: The sum you acquire that gets kept into your record.

- Premium: What the bank charges you to loan you cash. Your yearly rate (APR) incorporates your loan fee and paid forthright expenses, similar to beginning charges. For most private loans, you have a proper financing cost, and that implies your regularly scheduled installments won’t change over the existence of the loan. Loan not set in stone by your financial assessment and history — the higher your FICO assessment, the lower your loan fee.

- Charges: Extra expenses of applying for a new line of credit, for example, start charges, late charges, deficient assets expenses and the sky is the limit from there.

Your regularly scheduled installment depends on the obligation and reimbursement term. A $5,000 loan paid north of five years will have lower regularly scheduled installments than a $5,000 Loan Calculators Work north of three years on the grounds that the installments are fanned out over a more drawn out period. However, remember that your financing cost and any related expenses are additionally added to each loan installment.

Loan payment formula

The straightforward loan installment recipe incorporates your Loan Calculators Work, your financing cost and your loan term. Your chief sum is spread similarly over your loan reimbursement term and interest charges due over the term. Albeit the quantity of years in your term could vary, you’ll ordinarily have 12 installments consistently.

The sort of loan you have decides the kind of loan adding machine you want to use to sort out your installments. There are interest-just loans and amortizing loans, which incorporate head and interest.

Interest-only loans

With interest-just loans, you’re liable for paying just the interest on the loan for a predetermined period of time. How much head you owe will remain something very similar during that period. Month to month loan costs are quite simple to compute.

We should work out your expenses on the off chance that you have a $20,000 loan with a 6 percent APR and a reimbursement term of 10 years. For this situation, you would take the sum you acquired and increase it by your financing cost. This figure would address your yearly interest costs, which you would isolate by a year:

- $20,000 x 0.06 = $1,200 in interest every year

- $1,200 separated by a year = $100 in interest each month

Obviously, interest-just loans don’t endure forever. When the interest-just time of your Loan Calculators Work, you’ll be expected to reimburse the chief sum you acquired. Regularly, interest-just loans transform into amortizing loans expecting you to make regularly scheduled installments on head and interest after the interest-just period closes.

![]()

Amortizing loans

Amortizing loans apply a portion of your installment toward your chief equilibrium and interest every month.

Vehicle loans are a sort of amortizing loan. Suppose you took out a car loan for $20,000 with an APR of 6% and a five-year reimbursement course of events. This is the way you would work out loan interest installments.

- Partition the loan fee you’re being charged by the quantity of installments you’ll make every year, normally a year.

- Increase that figure by the underlying equilibrium of your loan, which ought to begin at everything you acquired.

For the figures over, the loan installment recipe would seem to be:

- 0.06 isolated by 12 = 0.005

- 0.005 x $20,000 = $100

That $100 is how much you’ll pay in interest in the primary month. However, as you keep on taking care of your Loan Calculators Work, a greater amount of your installment goes toward the chief equilibrium and less toward interest. You can sort out every month’s advantage installment by doing a similar math shown above utilizing your new, lower loan balance.

Leave a Reply