Discount Factor is utilized to calculate what the benefit of receiving $1 eventually would be (the current worth, or “PV”) in view of the suggested date of receipt and the discount rate suspicion. To Calculate Discount Factor in Calculator net present worth (NPV), you should initially determine its discount factor. All in all, the discount factor estimates the current worth of an investment’s future worth. Find out what this implies, how to calculate discount factor, and how it’s applied in finance underneath.

The Discount Factor Calculator is utilized to calculate the discount factor, which is the factor by which a future income should be duplicated in request to obtain the current worth.

Calculate the Discount Factor (Step by Step)

The current worth of an income (for example the worth of future money in today’s dollars) is calculated by multiplying the income for each extended year by the discount factor, which is driven by the Calculate Discount Factor in Calculator and the matching time span.

By and large speaking, there are two ways to deal with calculating the discount factor, one way or the other, the discount factor is a component of the:

- Discount Rate

- Time span

The discount rate can be considered representing the level of return that you might have gotten by investing that dollar, assuming you had gotten it today.

The explanation you would like to have $1 today than $1 a long time from now is that in the event that you got the $1 a long time from now, you would have passed up an entire three years where you might have invested that $1 and wound up with more than $1 toward that time’s end.

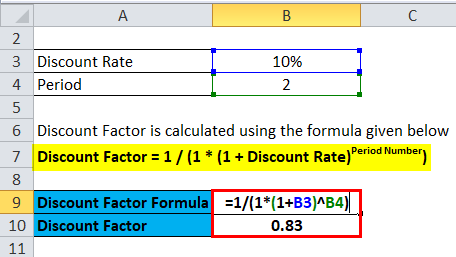

Discount Factor Equation

The main equation for the discount factor has been shown beneath.

- Discount Factor = (1 + Discount Rate) ^ (- Period Number)

What’s more, the equation can be re-organized as:

Discount Factor = 1/(1 + Discount Rate) ^ Period Number

Either equation could be utilized in Calculate Discount Factor in Calculator; however, we will involve the primary recipe in our model as it is a touch more helpful (i.e., Succeed re-organizes the actual equation in the main equation).

To show up at the current worth using the main methodology, the factor would then be duplicated by the income to get the current worth (“PV”).

- Present Worth (PV) = Income * Discount Factor

While the discount rate remains consistent all through the projection, the period number rising makes the factor decline over the long haul.

Note that the period can be anything length you need (years, months, days, even hours) – yet it is basic to guarantee that the period is lined up with the suggested time of the discount rate.

Intuitively, the discount factor, which is constantly calculated by one partitioned by a figure, diminishes the income values. This additionally attaches back to what we examined toward the beginning, where receiving $1 today is more important than receiving $1 later on.

Discount factor benefits

Understanding the discount factor is useful as it gives a visual portrayal of the effects of compounding over the long haul. This ascertains Calculate Discount Factor in Calculator. As the discount rate develops after some time, the income diminishes, making it a method for representing the time worth of cash in a decimal portrayal. By and large, investors can utilize this kind of discount factor format to make an interpretation of future investment returns into net present worth.

Leave a Reply