A laptop is taken at regular intervals, according to the examination firm Gartner, so protecting yours ought to be at the first spot on your list of motivations to get renters or property holders insurance. But, you might expect your guarantee covers your number one gadget. Would it be advisable for you to mind that your guarantee doesn’t include burglary? Dislike burglary is going to happen to you, Laptop Covered By Renters Insurance In USA? Try not to hold on until your laptop is swiped to acknowledge you needed insurance from the start.

Your renters insurance strategy might assist pay with repairing or supplant individual handheld hardware, including a car insurance for students living away from Home, on the off chance that they are taken or harmed by certain causes. The individual property inclusion in a renters insurance strategy normally helps cover your own belongings in the event that they are harmed or obliterated by a covered risk, frequently alluded to as a hazard.

Dangers that are covered by renters insurance might differ, however they commonly include fire, windstorms, lightning and certain sorts of water harm. Laptop Covered By Renters Insurance In USA robbery of your belongings. In the event that you utilize your work laptop for an at-home business, you should add an at-home business underwriting to your renters strategy to broaden inclusion for it. Assuming your manager possesses your laptop, the subject of who pays for fixes will be conditional.

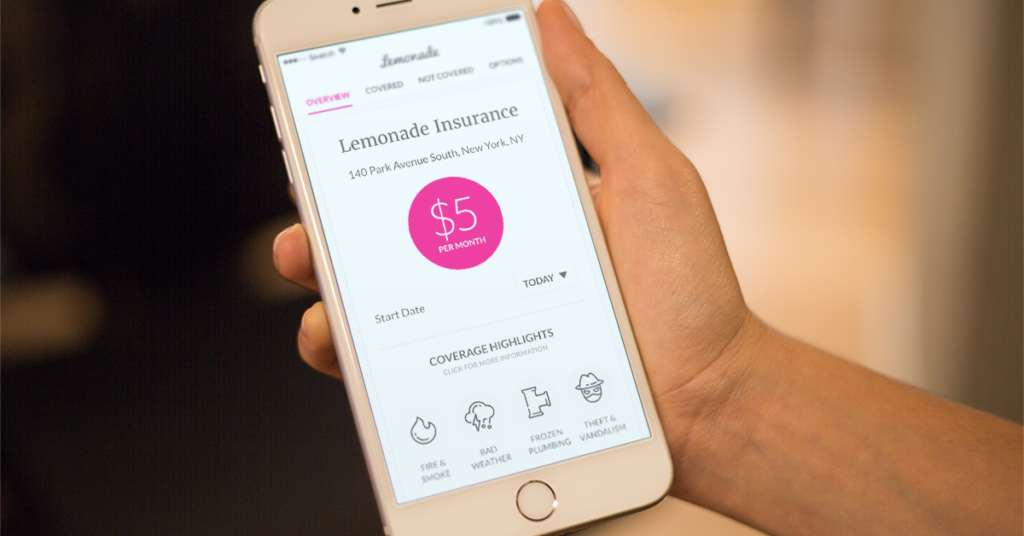

Lemonade Renters or Mortgage holders insurance for your laptop

On the off chance that you choose to safeguard your laptop (and the remainder of your stuff) with renters or home insurance, getting a strategy with Lemonade is simple!

You should simply get an essential insurance strategy, which takes under 2 minutes: Download the Lemonade application, answer a couple of inquiries regarding your home, and get insured in short order.

To ensure you’re getting sufficient inclusion for your PC (and everything else), twofold actually look at your ‘own property inclusion’ (insurance-represent inclusion for your stuff) is adequate. Otherwise, you could be left stranded when disaster strikes. Many state insurance guidelines (everything except New York and California) include an ‘Gadgets Cutoff of Obligation.’ Best to add the hardware underwriting, which grows your inclusion up to your items limit.

How much inclusion do I have for my laptop?

The amount of inclusion you possess for your gadgets relies upon the individual property inclusion limits expressed in your arrangement. A breaking point is the greatest sum a strategy will pay toward a covered case. You’ll need to realize your strategy cutoff points and how much inclusion they accommodate your electronic gadgets (as well as different belongings). Remember that you’ll likewise have to pay your deductible before your insurance supplier repays you for a covered misfortune.

At the point when you Laptop Covered By Renters Insurance In USA strategy, you’ll probably need to pick between “genuine money worth” and “substitution cost” inclusion. The sort of insurance you pick decides the amount you’ll be repaid for a covered misfortune.

For instance:

- Real money esteem inclusion: Considers deterioration while determining how much your strategy will pay out after a covered misfortune, for example, laptop robbery or harm brought about by a lightning strike or influence flood. Perhaps you burned through $800 to purchase your laptop or tablet quite a while back, at the same time, because of devaluation, that is not really what your insurance organization will cover on the off chance that you document a case today.

- Substitution cost inclusion: Accommodates the expense of a substitution gadget, of comparable make and model, in the present dollars. Premium expenses for this inclusion might be higher than the expense of genuine money esteem inclusion, however you’d probably have more prominent insurance.

At times, you might have the option to buy extra insurance for your gadgets. Your insurance supplier can explain what inclusion choices are accessible to you.

What does renters insurance cover on my laptop?

Since the individual property inclusion in a Laptop Covered By Renters Insurance In USA strategy commonly just applies to harm brought about by certain risks, it’s essential to comprehend when your laptop or other electronic gadgets endlessly may not be covered.

For instance, on the off chance that your laptop is harmed by a fire in your condo, renters insurance will presumably assist pay with repairing or supplant it. Likewise, your renters strategy might go about as laptop insurance — providing inclusion in the event that a laptop is taken from the spot you’re renting. (Again, your inclusion cutoff and deductible will apply.)

Nonetheless, renters insurance doesn’t cover unintentional harm to your laptop. In this way, in the event that you knock your laptop off your work area, the expense of repairing the broke screen wouldn’t be covered. Renters insurance additionally doesn’t cover lost or misplaced things.

Furthermore, renters insurance doesn’t cover fixes to a laptop or electronic gadget on the off chance that a section breaks or it essentially quits working. (Actually take a look at your gadget’s guarantee, notwithstanding, to check whether the vital fixes are covered by the producer.)

It could be difficult to picture existence without your laptop, tablet or cell phone, which is the reason it’s a good idea to comprehend what kind of inclusion your renters insurance strategy gives. Your representative can assist you with reviewing your arrangement so you can determine whether you have the inclusion that is appropriate for you.

Does renters insurance cover work laptops possessed by your manager?

Assuming that your boss possesses your work laptop and you harm it, whether they will pay to fix or supplant the laptop truly relies upon Laptop Covered By Renters Insurance In USA. A few organizations could remove the maintenance costs from your compensation, where others may very well give you another laptop to use for work. In any case, assuming you harm your work laptop and your manager finds that you’re at risk for the harm, then you may be stuck paying personal for the fixes.

All things considered, you might have the option to document a renters insurance risk guarantee to pay for your work laptop. Your risk inclusion safeguards you from financial obligation assuming you make harm another person’s property. Be that as it may, there are cutoff points of obligation with regards to this inclusion, and your work laptop could surpass your approach’s cutoff, meaning it probably won’t be completely covered.

Leave a Reply