There has been an adjustment of the reasoning of the huge crypto financial backers known as whales. Information shows USD coin (USDC) has turned into the stablecoin of decision on the Ethereum blockchain, not the bigger tie (USDT).

In crypto, whales are the greatest digital money holders – institutional financial backers, trades, profound took people – who are fit for moving a lot of tokens and influencing market costs. Examiners intently watch their action to recognize drifts and expect huge cost developments.

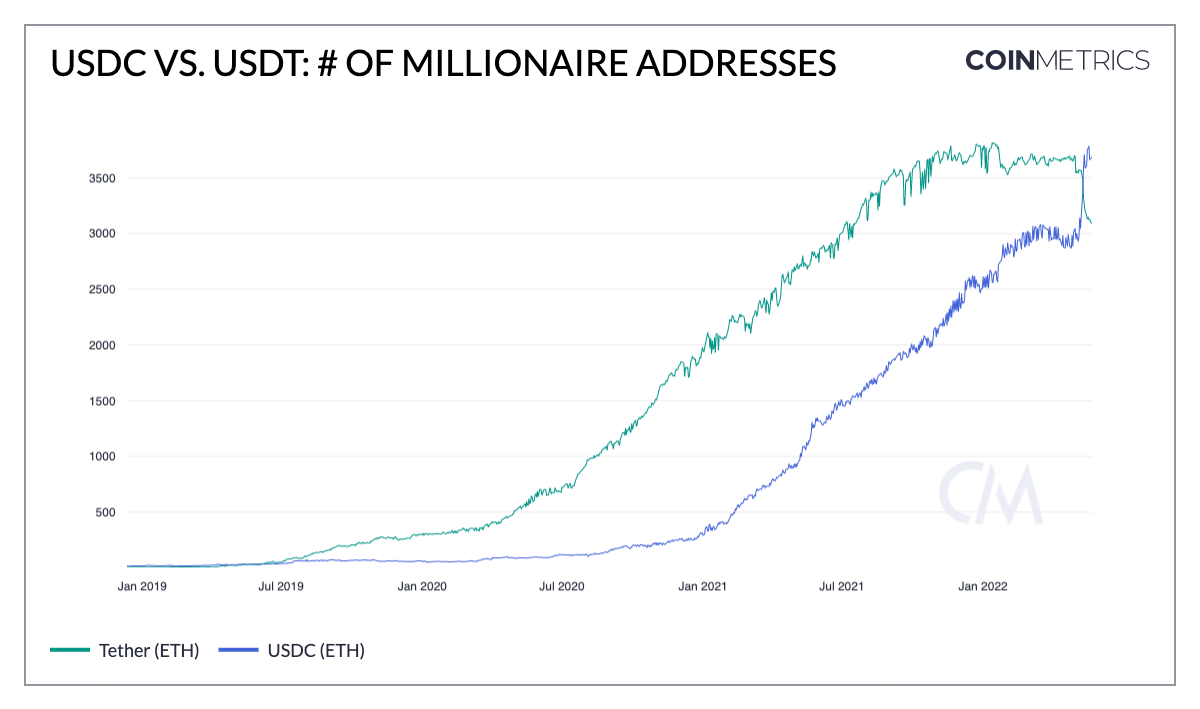

Information from CoinMetrics, a blockchain examination firm, shows wallet addresses on the Ethereum blockchain that hold more than $1 million USDC outperformed the quantity of wallets that hold USDT, still the biggest stablecoin by market cap.

“In the ongoing economic situation, a many individuals view USDC as the more secure, favored stablecoin,” Edward Moya, exchanging stage Oanda’s senior market expert, told CoinDesk.

USDC, the second-biggest stablecoin, has been acquiring piece of the pie since the once-$18 billion UST stablecoin fell and USDT’s stake to the dollar wobbled.

CoinMetrics took a gander at blockchain information since May 9, when UST lost its stake to the U.S. dollar. The firm distinguished 147 Ethereum wallet tends to that expanded their USDC surplus by no less than $1 million while diminishing their USDT total by somewhere around $1 million. Among them, there were 23 that additional no less than $10 million USDC and discarded $10 million USDT. Large numbers of these addresses are trades, custodial administrations or decentralized finance conventions, the report added.

The report additionally said USDC’s benefit over Tether’s USDT in supposed free float supply – the quantity of tokens that financial backers hold – on the Ethereum blockchain hit an unsurpassed high on Tuesday among all holder gatherings.

“This probably mirrors the way that main huge holders are by and large advantaged to reclaim USDT and mint new USDC to catch an exchange,” Kyle Waters, examiner at CoinMetrics, wrote in the report. “However, it could likewise be the situation that a few enormous records are de-taking a chance with their possessions, going to the apparent confirmations of USDC’s month to month verifications and full-save backing.”

Tie, the organization behind USDT, decreased its business paper property by 17% from $24.2 billion to $20.1 billion in the main quarter, as per its most recent, quarterly, confirmation report of the resources backing the stablecoin. In any case, it likewise said $286 million of its resources were being held in non-U.S. Depository bonds with a development of under 180 days.

USDT has endured $10 billion in reclamations by and large since the UST disappointment, which shook financial backers’ confidence in the soundness of stablecoins overall. Reclamations pushed down the generally speaking flowing stockpile of USDT to $73 billion from $83 billion out of 10 days. In a similar period, USDC’s stock rose to $53 billion from $48 billion.

In the midst of the whirlwind of occasions as UST’s worth dropped to almost zero in practically no time, USDT momentarily lost its stake to the dollar. Despite the fact that its cost immediately recuperated to $1, the wobble recharged vulnerability about what resources back the worth of USDT.

Most decentralized finance (DeFi) exchanges happen on the Ethereum blockchain, and USDC has been the stablecoin of decision in DeFi.

For instance, DAI, the biggest decentralized and overcollateralized stablecoin, is holding USDC rather than USDT in its depository. DAI, the cash of the blockchain convention MakerDAO, has a market capitalization of more than $6 billion and keeps its 1:1 trade proportion to the U.S. dollar by accumulating significantly more crypto resources than the market worth of all the DAI tokens available for use.

Also Read: DURING THE WAR UKRAINES WIDE USE OF CRYPTOCURRENCY IS PLAYING OUT

Leave a Reply