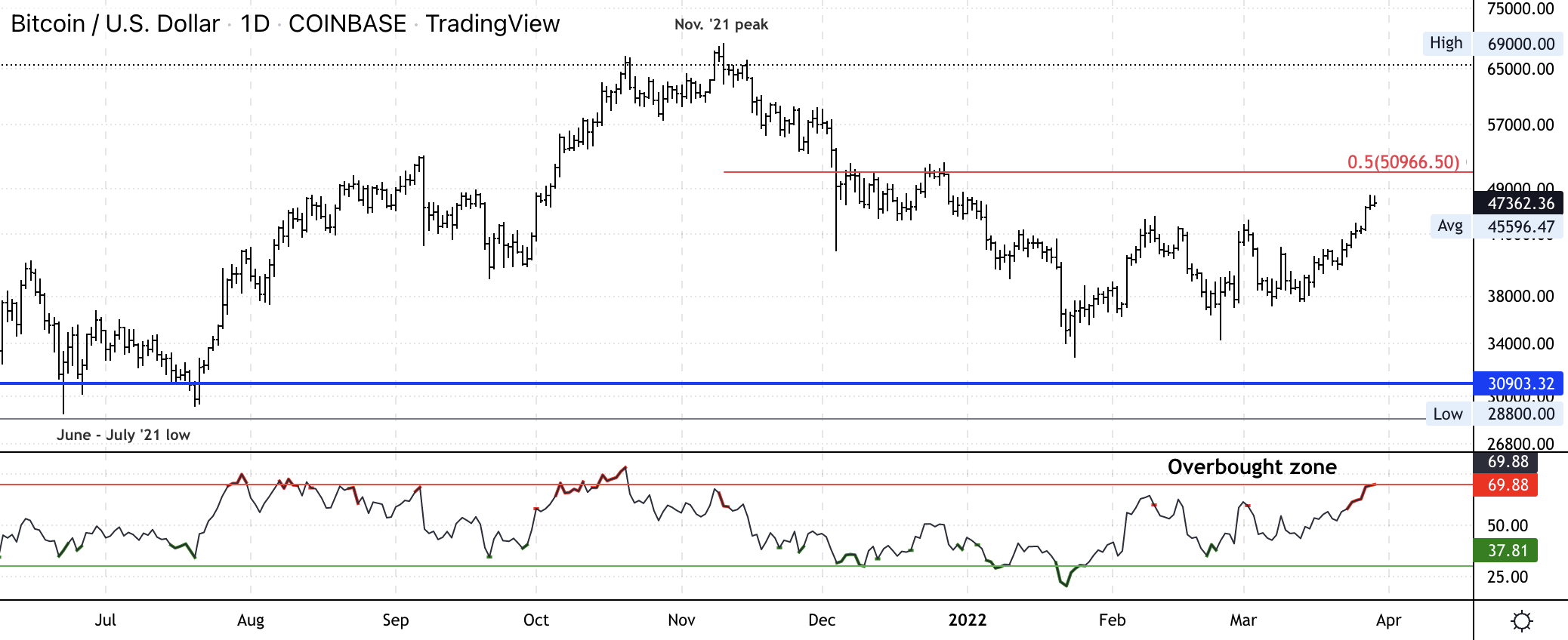

Bitcoin (BTC) is trying opposition at the 200-day moving normal, which could set off a short pullback.

The cryptographic money was exchanging at about $47,300 at press time and is generally level throughout the course of recent hours.

Potential gain energy is beginning to blur on intraday graphs, which could keep purchasers uninvolved into the Asia exchanging day. All things considered, lower support at around $45,000 could balance out pullbacks.

The overall strength record (RSI) on the day to day diagram is overbought without precedent for a very long time, and that implies venders could return at the $48,000-$51,000 opposition zone – a half inversion of the earlier downtrend.

Further, BTC is two days from enlisting a countertrend sell signal, agreeing the DeMark pointers, like what happened last August. At that stage, transient purchasers will probably shield support, particularly in light of the fact that energy signals turned positive on the week after week outline.

Also Read: On Which Way The Wind is Blowing For the Best Isa Returns

Leave a Reply