Calculate Home Equity Loan Payment is a kind of loan that involves your home as collateral to get the obligation. There are two sorts of home equity loans: home equity loans and home equity credit extensions (HELOCs).

Home equity loans are similar to personal loans in that the bank issues you a single amount payment and you repay the loan in fixed regularly scheduled payments. A HELOC operates similar to a charge card in that you get cash on an as-required basis. HELOCs accompany draw periods that normally last 10 years. During this period, you can utilize cash from the credit line, and you’re just answerable for making revenue payments.

The two choices expect you to have a certain amount of home equity; this is the part of the home you actually own. Moneylenders typically expect that you have between 15% and 20 percent equity in your home to take out a home equity loan or credit extension.

One drawback is that home equity loans and credit extensions have shutting expenses and charges similar to a standard mortgage. Shutting costs vary, however can run into the thousands of dollars based on the value of a property.

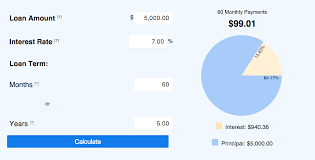

Home Equity Loan Calculator

This calculator will assist you with deciding if you’re qualified for a home equity loan or a home equity credit extension — and how much you could possibly get. Loan Calculators Work Just info your ongoing home equity and FICO rating and we’ll let you know how much home equity you may be qualified to finance.

The most noteworthy acceptable loan-to-value ratio contrasts by bank and property type (proprietor involved or speculation). Moneylenders frequently require proprietor involved homes to have something like 80% LTV and speculation properties to have something like 70%. We’ve assumed this is a proprietor involved home.

How much will my home equity loan payments be?

This tool calculates regularly scheduled payments for an amortizing loan and interest-just payments on a credit extension.

The home equity loan choice amortizes the loan balance over the long term loan, bringing about a loan payoff at maturity. The credit extension assumes the client just makes interest payments on the full credit extension. At the finish of the term, the amount owed on the credit extension will be exactly the same as the amount acquired.

How to build home equity

Building home equity is the initial step to obtaining a home equity loan. It’s significantly easier to build equity in the event that you made a larger down payment on the home initially, because you already have a sizable stake in the property.

Another way to build equity is to increase your home’s value by renovating it. (Remember certain home improvement projects have a more grounded profit from speculation than others.) In addition, you can build equity faster by making extra payments towards your mortgage principal, like fortnightly payments or one additional payment a year.

How to apply for a home equity loan

To apply for a home equity loan, start by checking your FICO rating, calculating the amount of equity you have in your home and evaluating your finances.

Then, research home equity rates, least necessities and expenses from different moneylenders to decide if you can afford a loan. At the same time, make sure the bank offers the kind of home equity item you want — some main proposition home equity loans or HELOCs rather than both.

At the point when you apply, the loan specialist will ask for personal information, for example, your name, date of birth and Social Security number. You’ll also be asked to submit documentation, which may incorporate tax returns, pay stubs and confirmation of homeowners insurance.

How does a home equity loan work? What are the benefits?

It resembles having a subsequent mortgage. You are taking out a loan utilizing the equity you at present have in your home as collateral. In the event that you haven’t paid off the loan before you sell the house, it will be deducted from the sale cost. Loan Calculator In the event that you don’t make payments, you may lose your home as the bank could offer it to recover the lost cash. Then again, the rates are usually very great compared to other transient loans.

It used to be that you could deduct any interest on a home equity loan in any case, everything being equal, late tax laws expect that the loan be for enhancements of the house. In this way, you can’t buy a car utilizing a home equity credit extension and deduct the interest. For home enhancements, it makes sense, especially for large rebuild occupations since the interest can be deducted (at least up to the maximum amount allowed with the new tax laws).

Shared equity agreements work like this. Investors give homeowners a single amount in exchange for a share later on value of their homes. At the point when the homes are sold (or when the contract term closes), the investors accept their share from the sale. Assuming that the value of the house increases, so does the amount the investor gets. Assuming the house drops in value, the investor also shares in the misfortune.

How do I figure out what the equity of my home is for an equity loan?

Tapping into your home’s equity can be an effective method for accessing cash rapidly to pay for renovations or work on your financial picture, however it’s important to tread carefully while getting against the rooftop over your head.

Normal choices for accessing your home’s equity incorporate a cash-out refinance, a home equity loan or a home equity credit extension, each of which can be utilized to cover all that from home upgrades to obligation consolidation, school expenses and even crisis costs.

At the point when you apply for the loan an appraisal will be made on your home to decide the value. The bank will loan you up to a percentage of this value short the balance of your most memorable mortgage… and will also run a credit check. Usually the expense of your appraisal is part of your end costs. In the event that you want an unpleasant idea of your home’s value you can utilize Zillow to get a comparison or ask a realtor for a market analysis. However, the formal appraisal is what a loan specialist will go by.

Leave a Reply