Kindly utilize the sharing apparatuses found through the Digital Collectibles Craze Hit its Peak offer button at the top or Chris Dixon side of articles. Replicating articles to impart to others is a break of FT.com T&Cs and Copyright Policy. Email [email protected] to purchase extra freedoms. Supporters might share up to 10 or 20 articles each month utilizing the gift article administration.

Web collectibles going from cartoon chimps to artsy doodles have plunged in esteem as true clash and a more extensive cryptographic money droop starts to loosen up one of the previous year’s greatest speculative furors.

Also Read: NFT Collection of John Terry

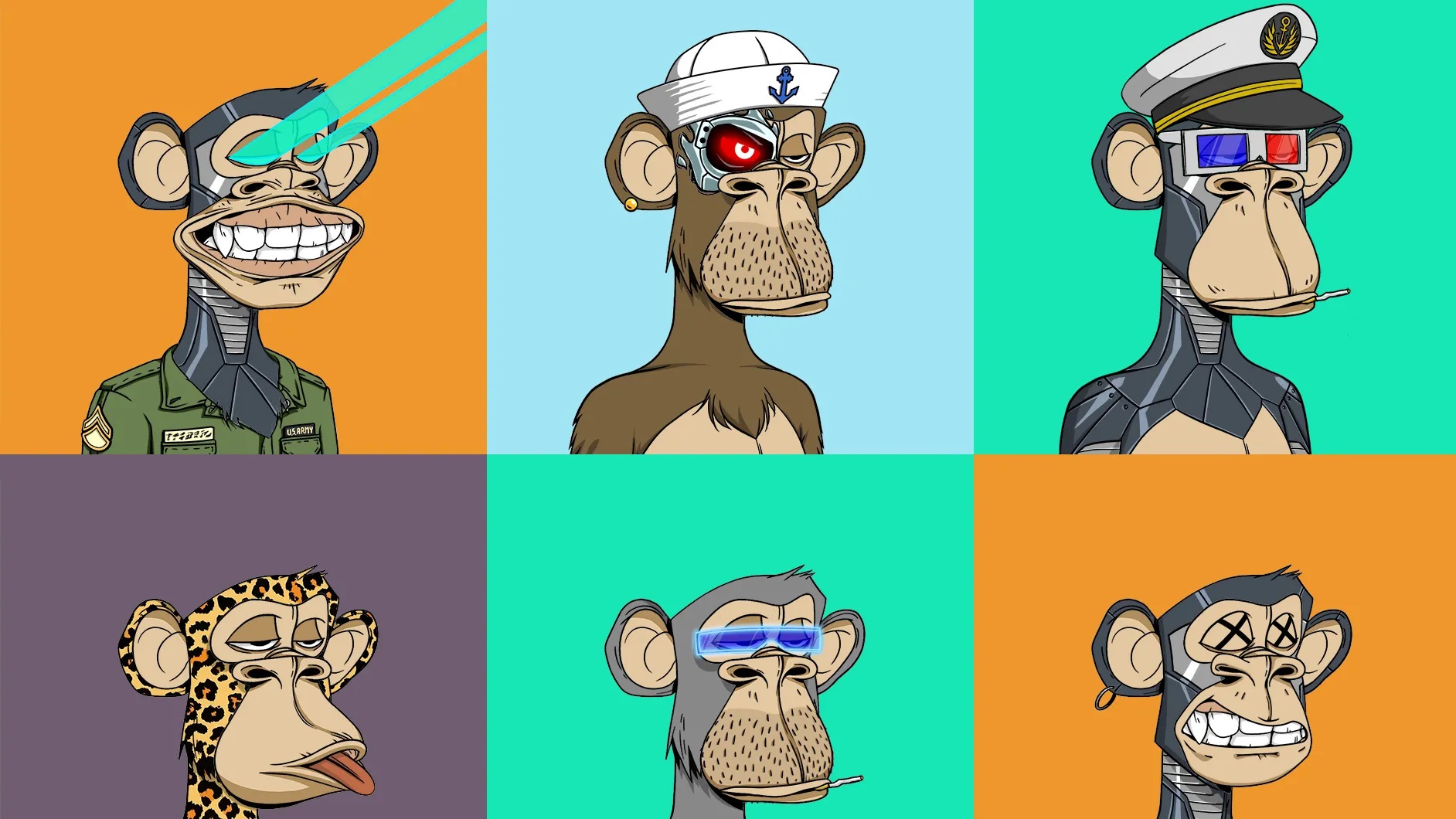

Digital things known as non-fungible tokens burst into standard culture last year, as a few creature assortments including Bored Ape Yacht Club, Cool Cats and Pudgy Penguins spiked in cost, helped by superstar supports and web-based media publicity. Before the finish of 2021, almost $41bn had been spent on NFTs – making the market nearly as significant as the worldwide art market.

Yet, Digital Collectibles Craze Hit its Peak nearly as quickly, huge parts of the market have started to fall apart, leaving amateur financial backers with large misfortunes and bringing up issues about the drawn out standpoint for NFTs.

The normal selling cost of a NFT has dropped more than 48% since a November top to around $2,500 throughout recent weeks, as per information from the site NonFungible. Everyday exchanging volumes on OpenSea, the greatest commercial center for NFTs, have dove 80% to generally $50mn in March, simply a month after they arrived at a record pinnacle of $248mn in February.

Leave a Reply