In the event that you’re an entrepreneur or business person, GST is something you’ll have to comprehend. Most organizations will be enrolled for GST, so it’s essential to comprehend what’s genuinely going on with it, and the responsibilities you have as an entrepreneur. Thus, we should investigate Minus GST on Calculator is, how to ascertain it, and how to ensure your record-staying up with the latest to report rehearses.

GST perseveres for Labor and products Duty that India’s Administration has demanded at the national or state level. GST calculator online, high level by different outsider sites, can be drilled to decide the appropriate expense of GST. Indian Gst calculator is a tool that backings in computing the GST sum on various labor and products accurately. The GST calculator’s goal is to show the total worth of labor and products, including GST.

In some cases computing Minus GST on Calculator as an entrepreneur can be precarious; furthermore, you have such countless different things on your plate that you don’t have any desire to invest your energy and intellectual prowess on little maths aggregates like adding and deducting GST. That is the reason we made our new GST calculator — on the grounds that we need to assist entrepreneurs who with requiring a simple to-utilize, straightforward tool that assists them with computing GST rapidly.

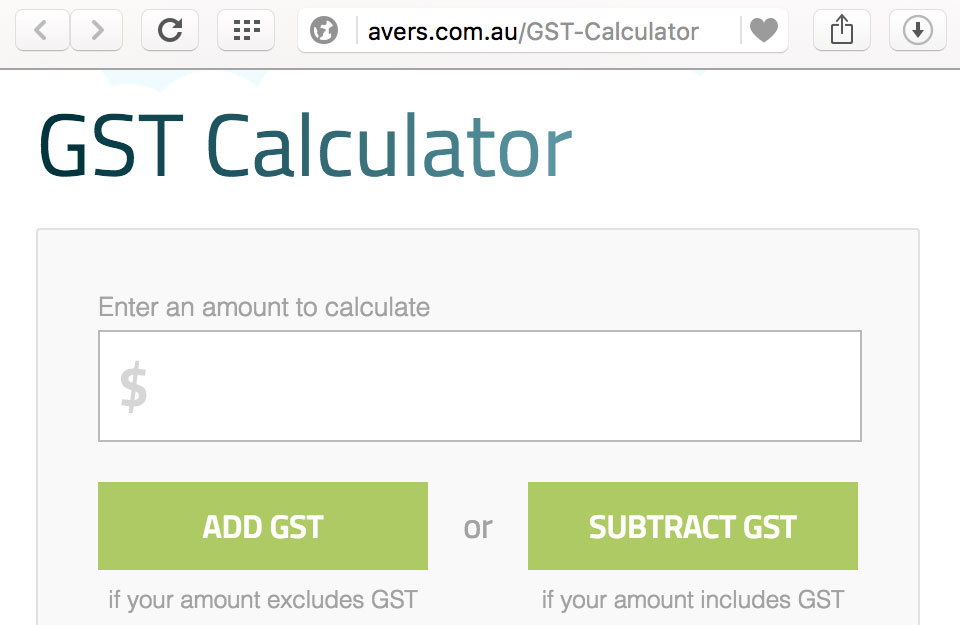

How to utilize the GST calculator

In the event that you have a value that does exclude GST however you want it to, simply add that cost into the primary field and snap the ‘Add GST’ button. The calculator will do the maths for yourself and show you the cost with GST in the ‘Cost’ field (and the GST that the cost contains in the ‘GST’ field).

Assuming that you have a value that Minus GST on Calculator and you need to figure out what the cost would be without GST, enter the cost in the primary field, click ‘Deduct GST’, and you’ll find the first cost in the ‘Cost’ field and how much GST in the ‘GST’ field.

Easy Tricks to Calculate GST

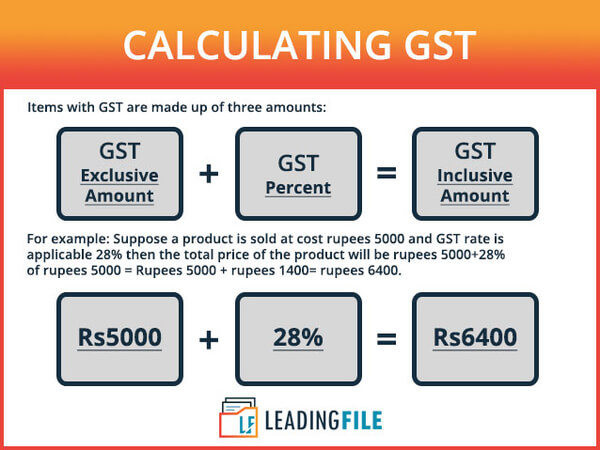

Since GST is 10% of the deal value, the calculator adds 10% of the cost to add GST, or deducts 10% to figure out the first cost.

Here is the maths behind it.

Adding GST:

To compute how much GST to add, simply duplicate the sum by 0.1.

To work out a total value, that incorporates GST, simply duplicate the sum by 1.1.

Taking away GST:

To compute how much GST is remembered at some cost, simply partition by 11.

To ascertain how much the cost was before GST, simply partition by 1.1.

That is a great deal of manual work for entrepreneurs to do each time they need o compute Minus GST on Calculator— utilize our calculator all things being equal.

How to make the GST calculator easily accessible

Since our GST calculator is uninhibitedly accessible on the web, you can get to it effectively from your PC and different gadgets.

1. Add the GST calculator as a bookmark in your program

In the event that you utilize the calculator a ton on your PC, you might need to include it as a bookmark your program so you can get to it with only one tick.

To add the calculator as a bookmark, ensure you’re on the GST calculator page, then press Ctrl+D on the off chance that you’re on a PC or Cmd+D in the event that you’re on a Macintosh. Then you can pick whether you need to save it into an envelope or onto your bookmarks bar, and what you maintain that the bookmark should be named.

2. Add the GST calculator as an application on your phone

On iPhones: Open Safari and explore to the Minus GST on Calculator. Click the center Safari button (the crate with the bolt) and afterward ‘Add to Home Screen’.

On Android: Open Chrome and explore to the GST calculator page. Click the menu button and afterward ‘Add to homescreen’.

Leave a Reply