Crypto bank Nexo has situated itself lately as a possible acquirer of weak crypto firms.

In any case, information posted on the site of a bookkeeping firm shrunk by Nexo to give ordinary authentications on client adjusts shows that the moneylender might have experienced withdrawals like those that prompted inconveniences at rivals.

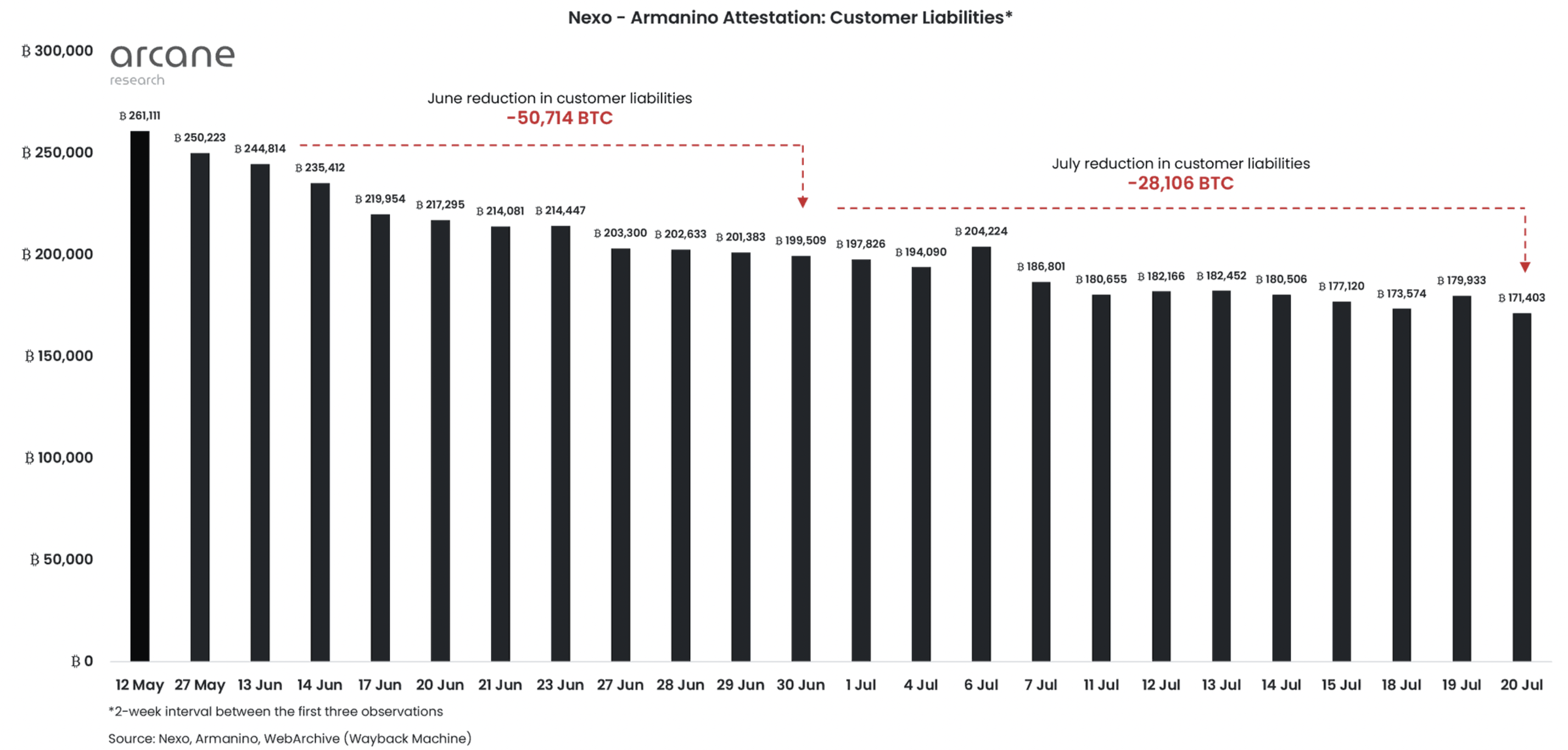

The Bulgarian company’s client liabilities – the worth of computerized resources clients kept on the stage – declined to $3.9 billion as of Thursday, down from $6.9 billion on May 12, in light of the continuous authentications given by Armanino LLP. CoinDesk got information on the earlier time span by getting to the Wayback Machine, a device that records prior renditions of sites for any kind of family down the line. Nexo is a privately owned business, so its budget reports aren’t freely accessible.

The drop in the client liabilities works out to about a 44% reduction. During that time, bitcoin’s (BTC) cost fell by around 20%, and the cost of ether (ETH), the second-greatest digital money, was down 22%. So market variables might represent a portion of the drop.

Client liabilities communicated in bitcoin terms, which helps sift through the vacillation in crypto costs, tumbled to 169,672 BTC from 261,111 BTC – a 35% drop over a similar period.

“It’s exceptionally normal way of behaving, given the condition of the market,” said Vetle Lunde, an expert at the crypto research firm Arcane Research who directed and distributed his own evaluation of the Nexo information prior in the week. “Nexo clients are mindful given the insecure economic situations and the liquidations partnered with other huge retail-arranged crypto loaning stages.”

A Nexo representative let CoinDesk know that the outpourings from the stage “are corresponding to the unpredictability in the space” and are thought of “moderately typical for such an uneven time” in the crypto market.

“They aren’t anything Nexo hasn’t seen prior to during past times of instability like the 2020 COVID alarm,” the representative added.

The current year’s accident in crypto costs has shaken nerves of retail contributors while likewise burdening enormous industry players with misfortunes on resources they had loaned out looking for yields. Celsius Network, a crypto moneylender, and Voyager, a crypto exchanging stage, each froze withdrawals and later defaulted on some loans. One more troubled loan specialist, BlockFi, got a credit help from crypto trade FTX, which later acquired a choice to secure the firm at a lofty rebate.

Nexo has up to this point stayed away from such extreme moves and seems to have avoided a portion of the most terrible failures. The stage figured out how to stay away from titles in the multibillion-dollar crash of the Terra blockchain and furthermore avoided the collapse of the crypto mutual funds Three Arrows Capital.

“As you might have perused from Three Arrows Capital’s uncover, Nexo’s name was not among those uncovered,” the Nexo representative said.

Nexo says it loans assets on a rigorously overcollateralized premise, a training that gives security on the off chance that a borrower defaults on the credit.

The Nexo representative stressed to CoinDesk that “at any second Nexo’s resources under administration surpass its commitments, meaning we are steady and ready to furnish clients with their assets whenever.”

Nexo’s procurement plans

Nexo has been vocal about hoping to gain by the shortcoming of contenders, describing itself as a consolidator in the crypto loaning space. The firm recruited financial monster Citigroup to encourage it on arrangements to obtain other crypto loan specialists.

Recently, Nexo marked a term sheet to gain Vauld, a debilitated crypto loaning stage supported by Peter Thiel and Coinbase Ventures that ended withdrawals, cut positions and hopes to rebuild. Recently, Vauld petitioned for assurance from lenders in Singapore.

“The Nexo and Vauld groups are in consistent contact encompassing the previous’ possible obtaining of Vauld,” the representative said. “Our group knew about the recording and that it would not the slightest bit influence our capacity to lead our expected level of investment, and assuming all that looks at, continue with a procurement.

“Nexo has a sweeping reserve for such arrangements and doesn’t involve clients’ assets for such action in any capacity.”

Less stores on Nexo “may have second-request impacts, in this case affecting Nexo’s income” from loaning, Arcane’s Lunde said.

The stage’s utility token, nexo (NEXO), is down 80% this year, at present exchanging at 70 pennies.

Also Read: Ubisoft delayed its Avatar game to make it perfect

Leave a Reply