Bridgewater Associates is planning to back its first crypto store.

The world’s biggest mutual funds is wanting to back an outer vehicle, two individuals told CoinDesk. It has no current aim of straightforwardly putting resources into crypto resources itself, one of the sources said.

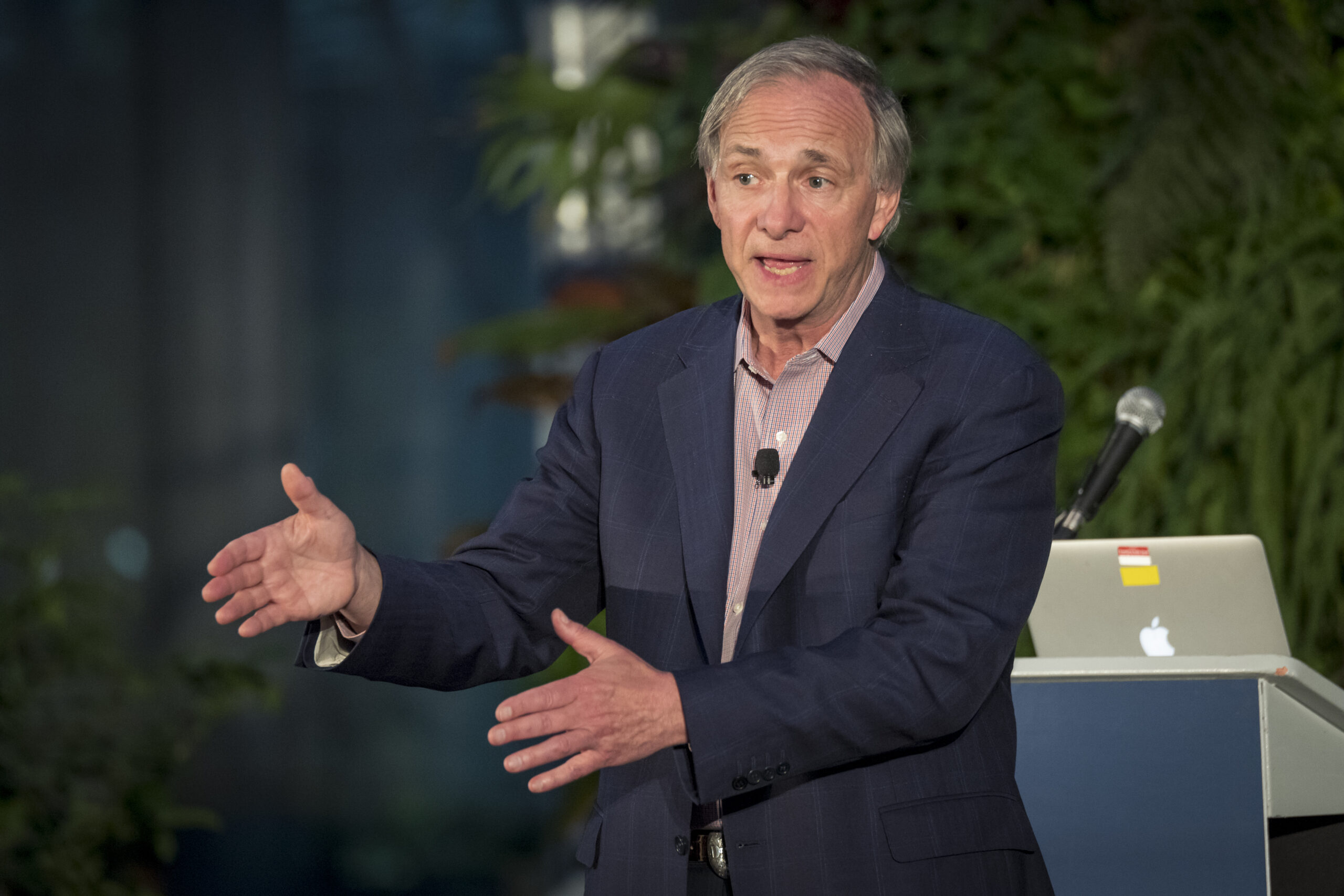

It’s the most clear sign to date that the world’s biggest mutual funds, right now with $150 billion in resources under administration (AUM), is approaching crypto in a serious way as a resource class – beside organizer Ray Dalio’s declaration in May 2021 of an individual interest in bitcoin (BTC).

All things considered, the size of Bridgewater’s speculation is microscopic contrasted with its complete AUM, one of the sources said, and other noticeable crypto financial backers are in converses with put resources into the asset.

At the point when arrived at last month by CoinDesk, a Bridgewater representative said the firm didn’t as of now have plans to put resources into digital currencies – notwithstanding four individuals saying the mutual funds monster was expected to enter the space by mid-2022.

“While we won’t remark on our positions, we can say Bridgewater proceeds to effectively investigate crypto yet isn’t as of now anticipating putting resources into crypto,” a Bridgewater delegate told CoinDesk through email on Feb. 22. Bridgewater gave a report on institutional crypto patterns in January.

The representative didn’t give a reaction to a solicitation for input sent Monday.

Connecticut-based Bridgewater was established in 1975 by Harvard Business School graduate Dalio from his Manhattan condo. Something of a supernatural figure in the realm of contributing, he has been public about specifically holding bitcoin, alluding to it as “one amazing creation.”

Bridgewater is plotting a comparative way to London-based flexible investments Marshall Wace, which was accounted for to be standing up a crypto store, similarly as Point72 and Brevan Howard.

A few sources were light on insights regarding the tie-up yet individuals CoinDesk talked with settled on a harsh timetable for Bridgewater’s crypto debut.

“Bridgewater is in a first-half arrangement this year,” said one individuals in February. “They’re anticipating having a little slug of their asset conveyed straightforwardly into computerized resources.”

Someone else acquainted with the flexible investments’ crypto exchanging plans said: “Bridgewater is hoping to reach out. They are doing not kidding ingenuity: liquidity, specialist co-ops and so forth.”

Also Read: The Energy Crisis and the End of ESG in Crypto Mining

Leave a Reply