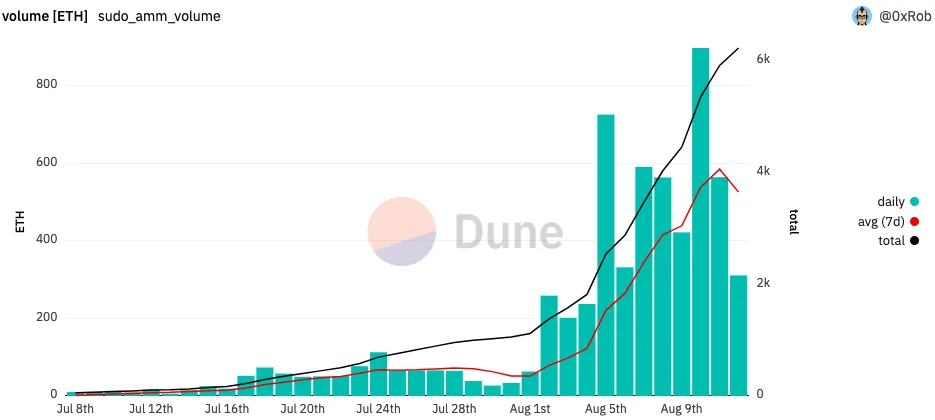

The achievement comes 35 days after the task was sent off. Interestingly, Coinbase’s NFT commercial center is yet to cross the $10M absolute volume mark — it’s at just $6.7M, 100 days in the wake of sending off on May 4.

‘Genuine Yield’

Kofi Kufuor, an accomplice at crypto-centered trading company 1confirmation, views sudoAMM as offering two significant incentives that would be useful.

First and foremost, sudoAMM permits anybody to effortlessly turn into a liquidity supplier for NFTs and procure charges.

“It’s one of only a handful of exceptional open doors in DeFi and NFTs to procure ‘genuine yield,” Kufuor told The Defiant. Genuine yield is an arising pattern, signifying projects circulating expense income in standard tokens like ETH or stablecoins. This is a long ways from the triple-digit yields of DeFi past, which were generally designated in a venture’s inflationary administration token.

SudoAMM permits clients to store a blend of NFTs from a solitary assortment and ETH, along a particular cost range called a holding bend. They can then acquire exchanging charges as different clients trade NFTs for ETH or the other way around.

Proficient Pricing

The commercial center’s other offer is that sudoAMM’s plan permits clients to immediately sell their NFTs into a pool, Kufuor said.

SudoAMM’s model works everything out such that clients can send a pool which will automatically trade a NFT at a given value, like breaking point orders. Clients likewise have the choice to sell NFTs quickly into a pool at a provided cost estimate, instead of tolerating a bid like on OpenSea.

SudoAMM’s energy is even more great since it comes when everything has gone badly for the NFT market — week by week volume has dropped from an unequaled week after week high of $6B in January to under $200M week after week since mid-June.

Also Read: After Creator Unveils IRL Toys Pudgy Penguins NFT Prices Surge

Leave a Reply